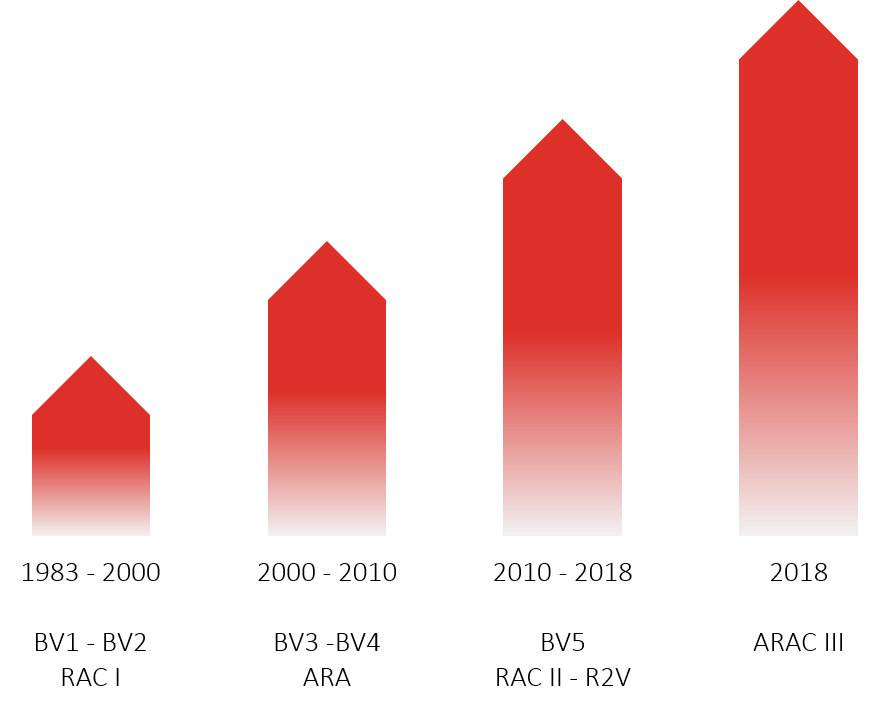

Our funds

Mor than 500 M€ raised in seed and venture capital fundsKREAXI is a major venture capital firm in France, with currently 4 regional seed funds and 2 european venture capital funds under management, representating more than 260M€ raised. Since more than 30 years, KREAXI has cumulated more than 500M€ raised from institutional investors to back and support innovative and ambitious startups.

Seed Funds

ARAC III

28M€ seed funds investing capital in early-stage startups located in Auvergne-Rhône-Alpes region (France). ARAC III funds invests from 150k€ to 2M€, with a 150k€ to 500k€ stake in a first VC round. ARAC III is currently investing.

RAC II

26,6M€ seed funds investing capital in early-stage startups located in Auvergne-Rhône-Alpes region (France). RAC II funds invested from 150k€ to 1M€, within 44 startups between 2012 and 2017. RAC II is under follow-up.

R2V

25M€ seed funds investing capital in early-stage startups located in Auvergne-Rhône-Alpes and Provence-Alpes-Côte d’Azur regions (France). R2V funds invested from 500k€ to 2,5M€, within 13 startups between 2014 and 2018. R2V is under follow-up.

RAC I

17M€ seed funds investing capital in early-stage startups located in Auvergne-Rhône-Alpes region (France). RAC I funds invested from 150k€ to 600k€, within 212 startups between 1990 and 2012. RAC I is under extinction.

Venture Funds

BV5

50M€ venture funds investing capital at Serie A stage in high-tech scale-ups (Web/Digital, Electronic, Medical). BV5 funds invested from 0.5M€ to 7M€ between 2010 and 2016. BV5 is under follow-up.

BV4

Our main investors

Any investor interested by investment products managed by Kreaxi are welcomed to contact us to get more information, either by phone of through our Contact page.